Deduct and pay taxes on behalf of e-commerce platforms from 2025

- Vinex Official

- Aug 21, 2025

- 1 min read

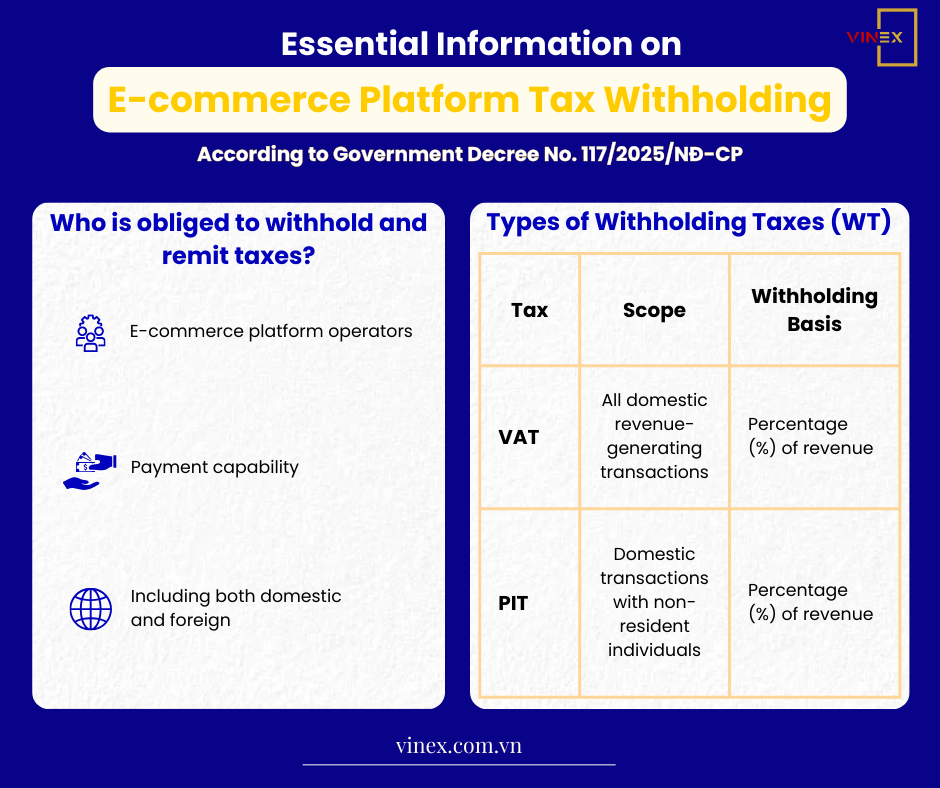

According to Decree 117/2025/ND-CP , from 2025, organizations managing e-commerce platforms with payment functions will deduct and pay taxes on behalf of business households and individuals.

Main content of the regulation

Applicable taxes: Value Added Tax (VAT) and Personal Income Tax (PIT)

Subjects: Households, individuals residing and non-residents doing business on e-commerce platforms

Deduction time: Immediately after order is confirmed and payment is successful

Meaning of the regulation

The new regulation aims to increase transparency in online business activities, while helping businesses comply with tax laws more conveniently and avoid legal risks.

Details of the regulation are shown in the figure below:

If you are still wondering about deducting and paying taxes on behalf of e-commerce platforms, Vinex team is ready to support and advise in detail.

Send us a message or call hotline 0981 111 811 to schedule a private consultation.

Comments